Wow, that was lucky, eh? (For my American readers, “eh”, pronounced “A”, is how we Canadians end every sentence, eh?). Lucky in the sense that the Dow had fallen through 10,000, and was clearly headed for the abyss, until everything got better, and everything was fine. From around 10,000 at 10:30 am, the Dow fell all the way to 9,840 around 2:00 pm, and then, in the last two hours of trading, staged an almost 200 point recovery to close at 10,012, for a gain of 10 points on the day. Whew. That’s only a loss of 5.63% on the week, and only 4% on the year, so all is well.

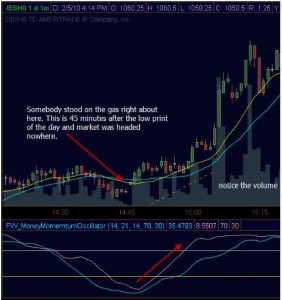

Thanks to sidewinder on the Buy High Sell Higher Forum for this chart of Friday’s action (the original image is here, or in his post on the Forum).

Strange, eh? 10,000 on the Dow (or 1,000 on the S&P 500) are important psychological barriers, and as the Dow fell under 10,000, all of a sudden, massive buying ensued, and the market closed slightly up on the day.

I guess most of the luck came from the jobs report; everything is great there. In the United states there are just under 130 million workers. Unfortunately that’s the same number of workers there were in 1999, and the working age population has increased by 29 million during that time period. Employment dropped by 5 million in 2009, and that was after billions in stimulus spending. That doesn’t sound good to me.

More numbers: The S&P 500 peaked around October 5, 2007 at 1,557, then fell so that by March 9, 2009 it was at 676, a drop of 56%. From that 676 level to the peak on January 19, 2010 at 1,150 the market recovered 70%. Or, stated another way, the market has recovered about half of what it lost in the 2007 to 2009 crash.

So the market miraculously recovers with two hours to go on Friday, to close just about 10,000 on the Dow. The market has recovered 50% of it’s losses from the peak. Sounds either like a manipulated market (probably), or a technically driven market (also probably). If it’s technically driven, a 50% bounce probably leads to at least a 50% retracement (so if the bear market rally has lifted the market from 676 to 1,150, a 50% retracement would take us back to around 913 or so on the S&P).

So what’s coming? As I said last week, the eerie silence will continue until we break one way or the other. I assume Monday and Tuesday will be up days, and then later in the week we will trend downwards, since that’s what’s been happening the last few weeks. I bought some puts a week ago, and sold them on Friday at a slight profit, and on Monday I may by some calls, hold them for two days, sell them, and repeat the process. Of course I won’t do it with real money; just pennies, for gambling purposes only. The bulk of my money will remain in cash, and will be deployed on better bargains in the coming weeks.

Gold

As for gold, we’ve had a correction, eh? From $1,225 to $1,065 in just over two months, or over 13%. Is the correction over? Who am I, Nostradamus? I have no idea.

If you want a guess, I would assume that support exists around the $1,050 blue up trend line, or around the 200 Day Moving Average around $1,018. So, my guess is $1,000 is good support, and a few dollars below that wouldn’t bother me in the least.

As for gold stocks, here’s the chart of G.TO – Goldcorp Inc. over the last two years (click on the chart to expand it):

Clearly the gold stocks have corrected more than gold itself, as is usually the case with leverage. The decisive break below the 200 DMA has already happened, but with the bounce on Friday the bottom could be in. Or not. My plan is to continue to wait. I will hold the stocks I own, and I will cover them (selling near term call options against what I own). I’ve sold February calls against all of my optionable gold and silver stocks, so if the market goes on a run in the next week I will be leaving money on the table. So be it, at this point I would rather protect against the downside.

I can’t ignore the negative news, so on the sidelines I will stay.

Enjoy the Super Bowl; I’ll see you next week.

{ 0 comments… add one now }

You must log in to post a comment.